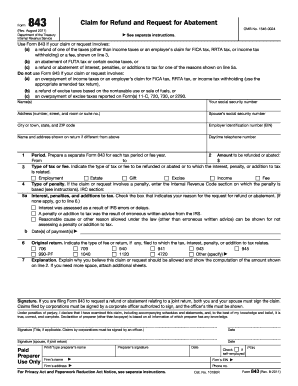

IRS 843 2024-2026 free printable template

Instructions and Help about IRS 843

How to edit IRS 843

How to fill out IRS 843

Latest updates to IRS 843

All You Need to Know About IRS 843

What is IRS 843?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 843

What should I do if I made a mistake on my IRS 843 after filing?

If you discover a mistake on your IRS 843 after submission, you have the option to submit an amended form. It is crucial to correct this as soon as possible to avoid complications. Follow the IRS guidelines for filing corrections and ensure that you include any necessary documentation to support the changes.

How can I track the status of my IRS 843 submission?

To track the status of your IRS 843, you can use the IRS online tool that allows you to verify if your submission has been received and is being processed. Be aware of common e-file rejection codes, as these can provide insight into any issues that may have arisen during submission. If your form was rejected, take corrective action immediately.

Are there specific rules for filing the IRS 843 on behalf of someone else?

When filing the IRS 843 for another person, you may need to provide additional documentation such as a Power of Attorney (POA) form. Ensure you comply with IRS regulations regarding authorized representatives, as the process can differ for business and individual filers. Understand the implications of filing on behalf of another party to ensure compliance.

What are common errors to avoid when submitting my IRS 843?

Common errors that filers encounter with the IRS 843 include providing incorrect taxpayer identification numbers and failing to sign the form. Take care to double-check all entries for accuracy before submission to reduce the likelihood of rejection or delays in processing. Additionally, consider reviewing past submissions to identify patterns of mistakes.

What should I do if I receive a notice from the IRS after filing my 843?

If you receive a notice or audit request from the IRS after filing your IRS 843, it is essential to respond promptly and thoroughly. Gather any required documentation that supports your filing and follow the instructions provided in the notice. Ignoring the request can lead to further complications and may require formal appeals if disputes arise.

See what our users say