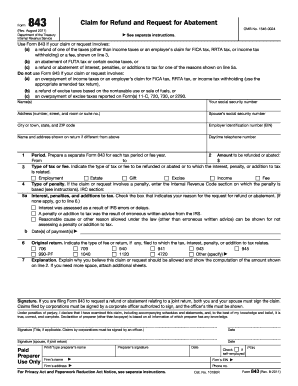

IRS 843 2024-2025 free printable template

Show details

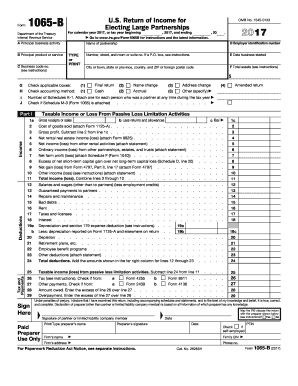

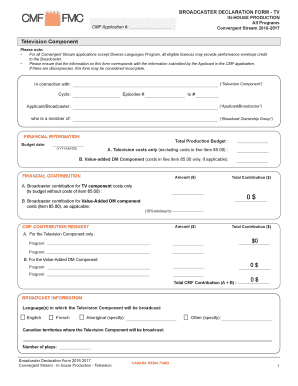

If you need more space attach additional sheets. Signature. If you are filing Form 843 to request a refund or abatement relating to a joint return both you and your spouse must sign the Form 843. Also do not use Form 843 to claim a refund of tax return preparer or promoter penalties. See instructions for the forms to use. Cat. No. 10180R Form 843 Rev. 12-2024 Page 2 Indicate the type of fee or return if any filed to which the tax interest penalty or addition to tax relates. Prepare a separate...

pdfFiller is not affiliated with IRS

Understanding and Utilizing IRS Form 843

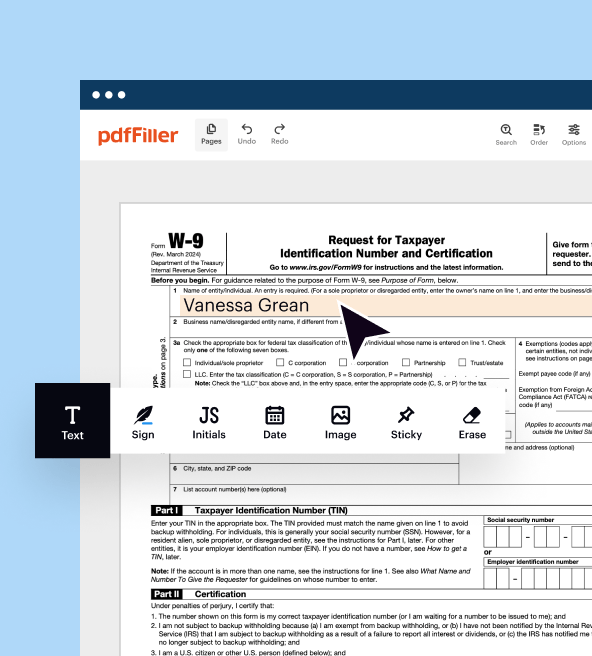

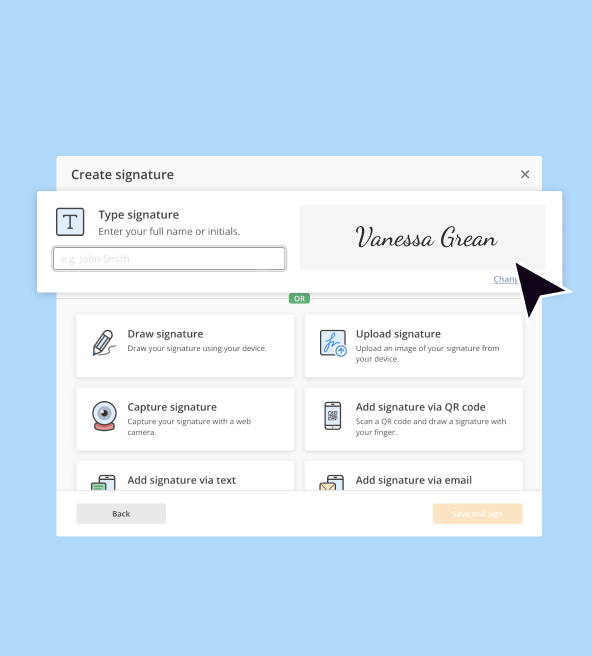

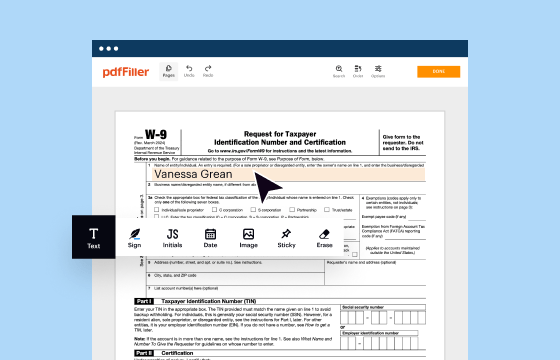

Step-by-Step Instructions for Editing IRS Form 843

Effective Guidance for Completing the Form

Understanding and Utilizing IRS Form 843

IRS Form 843 plays a crucial role for taxpayers seeking refunds or adjustments related to certain tax penalties. Familiarizing yourself with this form and its intricacies is essential for ensuring compliance and maximizing your tax benefits.

Step-by-Step Instructions for Editing IRS Form 843

Editing Form 843 requires a clear understanding of the information needed. Follow these actionable steps for effective completion:

01

Gather necessary documentation including original tax returns, payment records, and any prior correspondence with the IRS.

02

Download the latest version of IRS Form 843 from the official IRS website to ensure you have the most up-to-date format.

03

Review the instructions carefully, focusing on any recent updates or changes relevant to your situation.

04

Fill out the form clearly, ensuring that all information is accurate and legible. Use black ink for clarity.

05

Check for any applicable exemptions or conditions that may apply to your case.

06

Make a copy of the completed form for your records before submission.

Effective Guidance for Completing the Form

Completing IRS Form 843 is a straightforward process if you follow these guidelines:

01

Begin by entering your personal information in Part I, including your name, taxpayer identification number, and contact details.

02

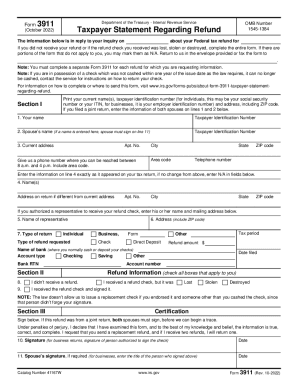

In Part II, specify the type of refund, penalty abatement, or request for an adjustment you are applying for.

03

Provide detailed explanations in Part III, describing why you believe an adjustment is warranted, along with supporting documentation.

04

In Part IV, sign and date the form before sending it to the appropriate IRS address.

Show more

Show less

Recent Amendments to IRS Form 843

Recent Amendments to IRS Form 843

Recent updates to IRS Form 843 have streamlined the process for obtaining refunds and adjustments. Notably, the IRS has revised certain eligibility criteria and instructions to enhance clarity.

01

As of 2023, the income thresholds for qualifying for penalty relief have shifted, enabling more taxpayers to take advantage of the form.

02

The IRS has also eliminated obsolete sections to reduce confusion and focus on pertinent information.

Essential Insights into IRS Form 843

Defining IRS Form 843

The Purpose of IRS Form 843

Who Needs to File This Form?

Eligibility for Exemptions

Components of IRS Form 843

Filing Deadlines for IRS Form 843

Comparative Analysis with Similar Forms

Types of Transactions the Form Covers

Required Copies for Submission

Penalties for Non-Compliance with IRS Form 843

Key Information Required for Filing IRS Form 843

Accompanying Forms with IRS Form 843

Submission Address for IRS Form 843

Essential Insights into IRS Form 843

Defining IRS Form 843

IRS Form 843 is a versatile document used to request refunds for specific overpayments, penalty abatement, or adjustments to your tax situation. It's essential for taxpayers seeking to correct errors or seek redress for excessive penalties.

The Purpose of IRS Form 843

This form serves multiple purposes, including:

01

Requesting a refund for overpaid taxes or penalties.

02

Appealing for a penalty abatement based on reasonable cause.

03

Requesting adjustments to previously filed tax returns.

Who Needs to File This Form?

Taxpayers who have experienced overpayment, faced penalties, or require adjustments to their tax situation should consider filing IRS Form 843. This includes individuals, businesses, and non-profit organizations that meet specific qualifying criteria.

Eligibility for Exemptions

Exemptions from penalties or overpayments can apply based on several factors. Qualifying conditions include:

01

Income thresholds, such as household gross income below a certain limit.

02

Specific transaction types, including erroneously reported income.

03

Industries recognized for special tax treatment, such as agricultural or educational sectors.

For example, a taxpayer whose income fell below $40,000 and paid penalties due to erroneous advice from a tax professional may qualify for an exemption.

Components of IRS Form 843

The form consists of four primary parts: personal information, type of request, explanation of circumstances, and taxpayer's signature. Each part must be completed accurately to avoid delays and ensure proper processing.

Filing Deadlines for IRS Form 843

The deadline for submitting IRS Form 843 varies based on the type of refund or adjustment being requested. Generally, taxpayers are given a three-year window from the original due date of the tax return or payment to file for a refund.

Comparative Analysis with Similar Forms

IRS Form 843 is often compared to other forms such as Form 1040X, which is used for amending a tax return. Unlike 1040X, Form 843 specifically addresses refund requests and penalty abatement rather than changing income figures or deductions directly on the return.

Types of Transactions the Form Covers

IRS Form 843 can cover transactions related to:

01

Overpayments due to mathematical errors on returns.

02

Excess penalties imposed for minimal infractions.

03

Adjustments in employee benefits misreported for tax purposes.

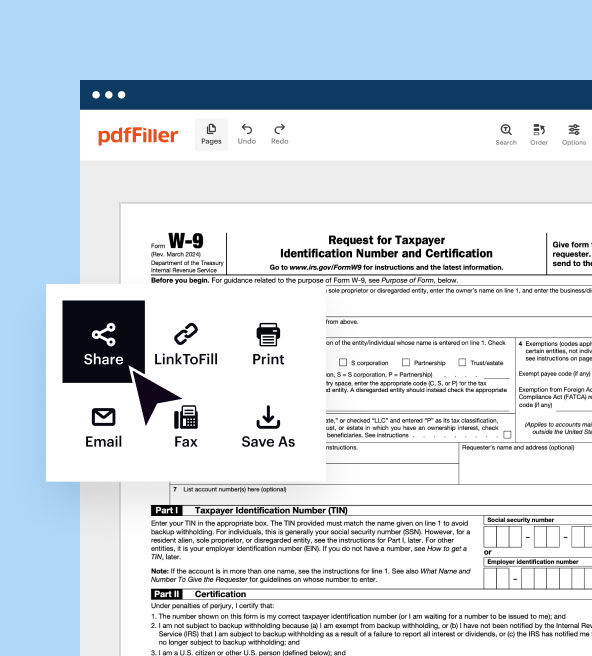

Required Copies for Submission

Generally, taxpayers should submit one copy of Form 843 to the IRS. However, it is advisable to retain a personal copy for your records. If you are submitting additional documentation, ensure those copies are complete and clearly labeled.

Penalties for Non-Compliance with IRS Form 843

Failing to file or submitting inaccurate information on Form 843 may lead to various penalties, including:

01

Financial penalties ranging from $250 to $10,000 depending on the severity of the error.

02

Legal consequences such as audits or increased scrutiny from the IRS.

03

Loss of eligibility for future tax refunds or adjustments.

For instance, an unfiled request for penalty abatement may result in penalties compounding against the taxpayer.

Key Information Required for Filing IRS Form 843

When preparing to file, ensure you have the following information on hand:

01

Your full name and taxpayer identification number.

02

Details regarding the penalty or overpayment in question, including tax year.

03

Documentation supporting your case, such as payment receipts and previous correspondence with the IRS.

Accompanying Forms with IRS Form 843

While IRS Form 843 can be filed independently, it may be necessary to attach other forms if specific circumstances warrant it. Commonly, Form 1040X may accompany it if adjustments to a tax return are being made concurrently.

Submission Address for IRS Form 843

The submission address for IRS Form 843 varies based on your location. Typically, it should be sent to the address listed in the form instructions. Ensure you verify the correct address to avoid processing delays.

For more personalized assistance with IRS Form 843, or if you have further questions, consider reaching out to a tax professional or utilizing resources like pdfFiller to help streamline your filing process.

Show more

Show less

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

the efficiency and clarity are five star.

This is exactly what I needed for my home business needs.

Thanks

Try Risk Free

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.